Survey Reveals Projects are 70 Days Late on Average

CARPINTERIA, Calif.--(BUSINESS WIRE)--

Procore Technologies, Inc. (NYSE: PCOR), a leading provider of construction management software, today announced a new survey from international research firm IDC that found most construction projects are delivered late and significantly over budget compared to the owners' original plan.

Procore Technologies, Inc. (NYSE: PCOR), a leading provider of construction management software, today announced a new survey from international research firm IDC that found most construction projects are delivered late and significantly over budget compared to the owners' original plan. (Graphic: Business Wire)

Conducted in May and June 2021 by IDC, and commissioned by Procore, the survey asked about the challenges owners face, and how they have responded to them. The survey also explored the benefits gained by moving from manual processes to technology solutions. Participants were construction project owners and developers in the public and private sectors in the U.S. and Canada. They are involved in various roles and responsibilities across the project delivery lifecycle, from conceptualization, pre-construction planning to project management, execution and operations.

Most Construction Projects Are Over Budget And Delivered Late

The survey revealed that 75% of owners were over planned budgets on their projects, and 77% were late. On average, projects were 70 days late compared to their original estimates.

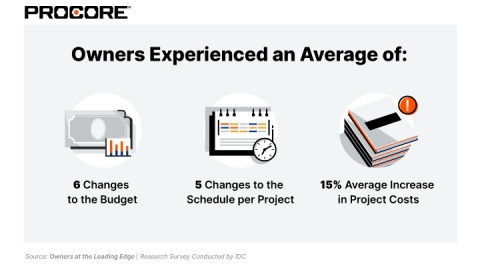

Per project, owners experienced an average of six changes to the budget and five changes to the schedule, with a 15% average increase in project costs as a result of these changes.

High Performers Use Digital Solutions

Most projects are late, but some respondents are doing better than others. The survey identified significant differences between high and low performers, based on variance between budget estimate and estimate for day and project completion time. Better on-budget and on-schedule performance often corresponded with embracing integrated technology. Two groups emerged:

-

High performers: The 17% of respondents who were least over their budget and estimate for days/completion time.

-

Low performers: The 19% of responding organizations who were most over their budget and estimate for days/completion time.

Low performers struggled with outdated or manual processes across project conceptualization, preconstruction planning, change order management, and incident tracking on the jobsite.

Owners who leverage digital solutions are generally delivering projects on budget and on schedule. Owners reliant on manual or siloed productivity solutions (e.g. Excel, SharePoint, Dropbox, local drive document storage, or outdated custom legacy solutions) are typically delivering projects late and over budget. To learn more, read the report here.

Technology Adoption and Integration Impact Performance

Most respondents are not using specialized construction-specific software instead relying on the kind of fragmented general productivity software used across many industries and offices (85%). The remaining 15% manage construction projects with software tools that are integrated together. As the construction industry continues the rapid innovation seen in recent years, those who adopt integrated industry specific technology solutions will be able to take advantage to get ahead, while the others will be left out/behind.

Owners recognize the importance of data centralization as a key building block for supporting new technologies that can help increase on-time and on-budget performance. The technologies they identified as priorities for long-term future adoption will require supporting application and data integration efforts to maximize benefits and results. The top technologies identified as priority for future adoption were:

-

Data centralization technologies (42%)

-

Predictive analytics for cost modelling (36%)

-

Building Information Modeling (BIM) (32%)

-

Digital twin (31%)

-

Green building/construction (30%)

“The survey shows that project owners can see what needs to be done,” said Warren Shiau, Research Vice President, IDC. “But if the adoption of these technologies is going to be effective, they need to look at modernizing their data, applications and IT infrastructure—or else they won’t be fully able to take advantage of these game changers.”

When it comes to budgeting and scheduling, owners predict the greatest impact on project performance in the next three years will be BIM (53%), connected supply chain (44%), pre-fabrication of components (41%), and predictive analytics for cost modelling (34%), according to the survey results.

Biggest Challenge: Finding Skilled Trades and Labor

Perhaps not surprising, owners identified that the greatest challenge to getting projects done is on-site labor shortages (69%). Only 24% of respondents said they are well-staffed, with the right skill sets around financial governance, reporting, and controls, and only 33% are well-staffed for planning, design, and scoping.

“Trade and labor is part and parcel of estimating project timelines and viability, so when there’s a labor shortage, it impacts costs. And the longer it takes to finish a project, the more your costs escalate. For companies without proper processes in place, these problems are only going to be exacerbated,” Shiau added.

Owners also saw environmental regulations (66%) and project cost escalations (61%) as challenges to their businesses.

“IDC’s survey is a wake-up call for construction project owners across North America,” said Zachary Reiss-Davis, Senior Manager, Product Marketing, Procore. “Budget and schedule overruns are the norm, and that shouldn’t be the case. The high performers surveyed show that adopting digital solutions helps keep budgets and schedules on track. Future success depends on modernizing technology infrastructure and adopting integrated construction management solutions that can help future-proof operations, alleviate staffing shortages and ensure efficient project delivery.”

About the Survey

This industry-wide survey included over 505 U.S. (303) and Canadian (202) construction project owners and developers including private corporations, governments, healthcare and education institutions, and commercial real estate owners and operators. Over the past 12 months, these owners have delivered varying types of projects, from capital improvements to industrial, including turnarounds, to ground-up development. Conducted in May-June 2021 by IDC, the survey sought to learn about owners’ challenges and how they’ve responded to them—or plan to. It also focused on changes being planned or adopted to improve processes, workflows, and application modernization, and what benefits can be gained by moving from manual processes to digital approaches.

To learn more, download the report, Owners at the Leading Edge: How construction project owners are using technology to achieve on-time, on-budget performance.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. IDC's analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly-owned subsidiary of International Data Group (IDG), the world’s leading tech media, data and marketing services company. Learn more at IDC.com.

About Procore

Procore is a leading provider of construction management software. Over 1 million projects and more than $1 trillion USD in construction volume have run on Procore's platform. Procore’s platform connects key project stakeholders to solutions Procore has built specifically for the construction industry—for the owner, the general contractor, and the specialty contractor. Procore's App Marketplace has a multitude of partner solutions that integrate seamlessly with Procore’s platform, giving construction professionals the freedom to connect with what works best for them. Headquartered in Carpinteria, California, Procore has offices in the United States, Canada and around the globe. Learn more at Procore.com.

PROCORE-IR

Source: Procore Technologies Inc.